Usdc expand at 2021 levels – what leads the increase?

Este artículo también está disponible en estñol.

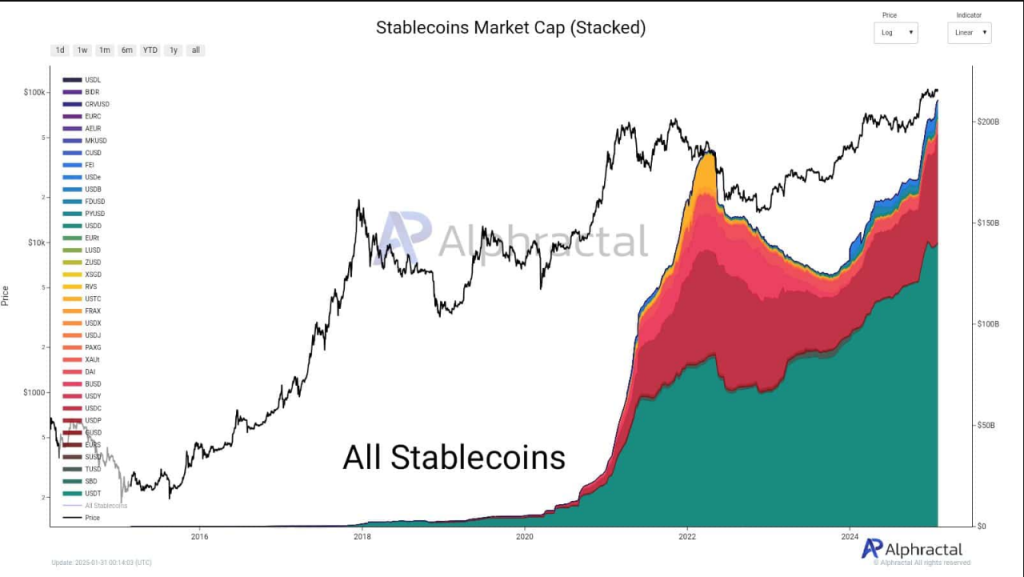

Stablecoins, which often takes the back seat of Bitcoin and other cryptocurrencies, are now in the spotlight. According to the data on the series, the Stablecoins market rose to more than 200 billion dollars, with USDT and USDC from Tether as major growth motives.

Related reading

Based on Cryptoquant data, the Stablecoins market has increased by $ 37 billion since the first week of November last year, when Donald Trump won his second presidency. The same encrypted report shared that Stablecoin’s performance may leak into Bitcoin and others Encryption.

Alphractal share the same data; This time, it highlights the increasing role of USDC in Stablecoins slice. According to Alphractor, USDC eats a USDT class, and feeds other Altcoins in industry.

Usdc near the key resistance level: alphractal

according to AlfrakalThe fixed expansion in the stablecoins market, but, with its connection at the top, is evidence of its perseverance. According to modern market data, trading in Altcoin helps get a preposition. The search claims that Altcoin sales are frequently transmitted to USDC, which enhances the supply in the market.

🚨 Cap Stableco Market exceeds $ 211 billion – USDC earns momentum!

Since 2023, the Stablecoin market has grown significantly, mainly driven by USDT (Tether). However, recently, USDC has gained an advantage over other stablecoins.

This trend occurs due to the last decline in … pic.twitter.com/irkrremce

– alphraractal (@alphractal) January 31, 2025

However, this currency approaches its resistance level, and repeated price movements were seen last time in 2021. Unlike its competitor, USDT has Tether, USDC with strong institutional support and organizational clarity. These are the main reasons that many USDC investors and institutions prefer from Tether.

What about other stablecoins?

USDC and USDT are still more popular Stablecoins, but the smaller Stablecoins has not grown since 2023.

The total market value of this alternative stablecoins remained as it is, indicating the presence of few new developments or growth behind the main coins.

Dependent dependence, poor and other poor popularity raises questions about Stablecoins. Like USDT, many of these “smaller stablecoin projects” face liquidity issues, lack of institutional support, and organizational uncertainty. Although it is good to grow the roof of the comprehensive Stablecoin market, it is also concerned that it is only dominated by two metal works: Usdt and USDC.

Related reading

Ascending or landing: a short -term look for USDC

The current USDC basic procedure is close to the critical resistance level, similar to its highest level ever in 2021. If it continues to control and overcome this resistance, this can translate into aversion to high risks, while moving away from the capital from the M. or altcoins . In short, it is a downward signal because people are looking for stability.

It is also interesting to note that USDC rose when Altcoins crashed in the price. This indicates that many investors get their gains.

Distinctive image from Infomness, the tradingvief chart