Stablecoins amounted to 200 billion dollars – a huge encryption raised at the forefront?

Este artículo también está disponible en estñol.

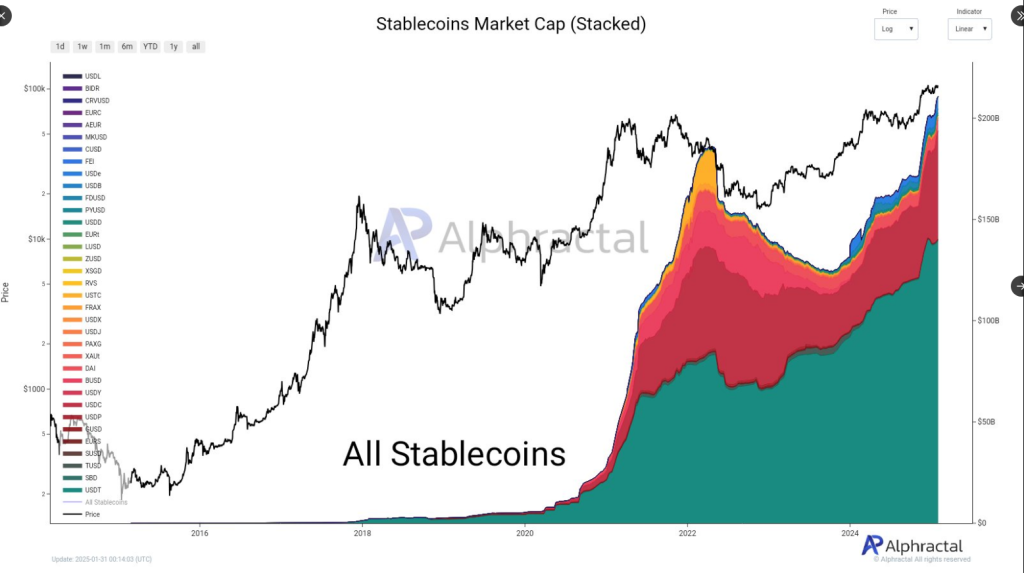

Over the past few months, Stablecoins has resulted in the limelight of its most speculative counterparts, including symbols inspired by politicians. However, modern data indicates that Stablecoins has returned and exceeded the maximum market of $ 200 billion.

Related reading

According to joint data by AlfrakalThe raising value of the sector increased to $ 211 billion, which is a high record, thanks to the months of stable growth, which began in mid -2013.

StablecoinsThe market value grew 73 % of its value in August 2023 at a value of $ 121 billion, the data issued on January 31 was updated. The main driver of the growth of this usdt part, however, USDC has gained a ground recently, which is great.

🚨 Cap Stableco Market exceeds $ 211 billion – USDC earns momentum!

Since 2023, the Stablecoin market has grown significantly, mainly driven by USDT (Tether). However, recently, USDC has gained an advantage over other stablecoins.

This trend occurs due to the last decline in … pic.twitter.com/irkrremce

– alphraractal (@alphractal) January 31, 2025

Usdt remains from Tether the main growth engine

Since 2023, the Stablecoin market has grown mostly, due Tether’s usdt. As of now, Stablecoins is $ 223 billion, which is 0.2 % over yesterday.

Interestingly, USDT and USDC are the current growth engines of Stablecoins. Aside from the numbers of both coins, the Stablecoins group has not changed much since 2023 and showed fixed and medium values. At the present time, its value is estimated at about 140 billion dollars, and USDC It is 53 billion dollars.

USDC is slowly acquired on other coins

The alphractal publication on Twitter/X shows that USDC has gained a floor on other Stablecoins on the market. According to The Post, this happens due to the low prices of Altcoin and since a large part of the sales operations have been replaced USDC.

The post also showed that USDC dominance in this sector reached the level of the main resistance, the same amount that was observed in 2021. This was the beginning of the bear market in 2022 when the Bitcoin price fell to $ 15,500. If this scale continues, it can serve as a downward signal to the market, which affects the decisions of purchase of investors. However, if this scale decreases, the USDC jumping plate may be the highest new levels.

Related reading

What can be expected from the short -term stablecoins

In the last bull race, the USDC supplies increased in May, then reached its highest level in March 2022. The maximum Stablecoin market increased by 170 % from April 2021 to March 2022. Stablecoin market may reach its peak within a few months.

Traditionally, the maximum growing market for Stablecoins reflects the confidence of the growing investors, which indicates an increase in capital flows.

On the contrary, the maximum stablecoin market is usually associated with the increasing condemnation of the investor, indicating the possibility of augmented capital flows. This indicates that the bullish momentum can last for another a few months.

Distinctive image from Gemini Imagen, the tradingvief chart