Analyst Bitcoin Massor explains to $ 150,000 – details

The Bitcoin (BTC) market recorded more than gains last week, which led to a net price of 2.37 %. However, investors and market experts alike remain very up to the first encrypted currency capabilities to achieve great gains in the current round of the bull.

Bitcoin is ready for $ 150,000 targeted price – analyst

in QuickTake Post On Cryptoquant, an analyst called Username Percival hired Bitcoin to achieve a price of $ 150,000 in the current bull cycle. Commenting on the current market situation that may be worrying for some investors, Percival states that the Bitcoin price track, which is characterized by sharp, upscale nails and monotheism periods, is similar to structural dynamics of any mature financial assets.

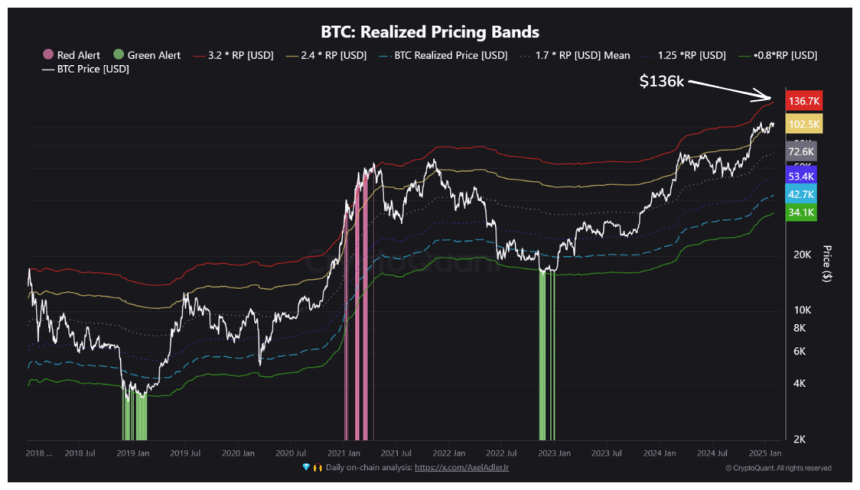

Regarding future price movement, the analyst points to the expansion of Fibonacci from a low Bitcoin cycle at $ 15450 in November 2022 to monotheism at $ 48,934 in 2024. In translating these historical data into the current market, Percival sets a targeted price for bitcoin between 136, 000 dollars. Supported by data from the achieved bitcoin achieved domains – the market scale that analyzes the supply based on the different purchase levels.

However, in order for Bitcoin to trade at $ 150,000, the original must achieve the total market value of $ 3 trillion. Currently, there are strong historical data to support this assumption. For the context, Percival explains that the achieved CAP Bitcoin has increased by 470 % in the previous declining cycle in 2021. Currently, the achieved CAP has grown by only 111 %, indicating more potential for market growth.

Moreover, the analyst determines the potential demand sources to raise the expansion of the expected market of $ 3 trillion, one of which is the investment funds circulated in the United States.

It is worth noting that these investment funds recorded nearly $ 40 billion in the flow during its commercial year for the first time in 2024. It is expected that the United States will adopt a supportive position in the Donald Trump administration, it is also possible that institutional demand will increase stronger through these areas Specified. In addition, PERCIVAL includes the Bitcoin Futures market, which is currently 95 billion dollars as another possible export engine to expand the expected market

BTC price overview

At the time of writing this report, Bitcoin is trading at 102,334, which reflects a 1.66 % decrease during the last day. However, the leading cryptocurrency rises by 7.93 % on the monthly graph after a strong positive performance in January.

According to data from the prediction site CoincodexThe market’s feelings are still difficult with the 76th fear and greed index, which indicates extreme greed among investors. Look forward, Coincode’s analysts expect that Bitcoin will trade at $ 113, 658 and 132,823 dollars in the next thirty -five, respectively. In particular, they prepare digital assets to exceed $ 150,000 in the next three months.