Smokes to predict prices for today, January 31 – Insidebitcoins

Join us cable A channel to stay in view of the coverage of urgent news

Prediction predicts indicates that StX show signs of unification and potential upward momentum, if the price successfully separates the upward trend, this may lead to a strong upholstery gathering.

Prediction data stations:

- The price of the price is now – $ 1.33

- The maximum markets of the market – $ 2.05 billion

- Smoking offer – 1.51 billion

- Total offer – 1.51 billion

- Coinmarketcap ranking – #55

Obtaining early encryption projects can be a change for games, as the date has shown with many distinctive symbols over time. Take the stack (STX), for example-since it has reached its lowest level at $ 0.04501 on March 13, 2020, it has risen at an amazing increase +2929.4 %, proving the long-term adherence strength in the correct projects. While its highest level ever reached $ 3.84 in April 2024 is a distant memory, STX is still a strong performer in the encryption space. Monitoring such symbols and their historical growth can help you identify promising opportunities early.

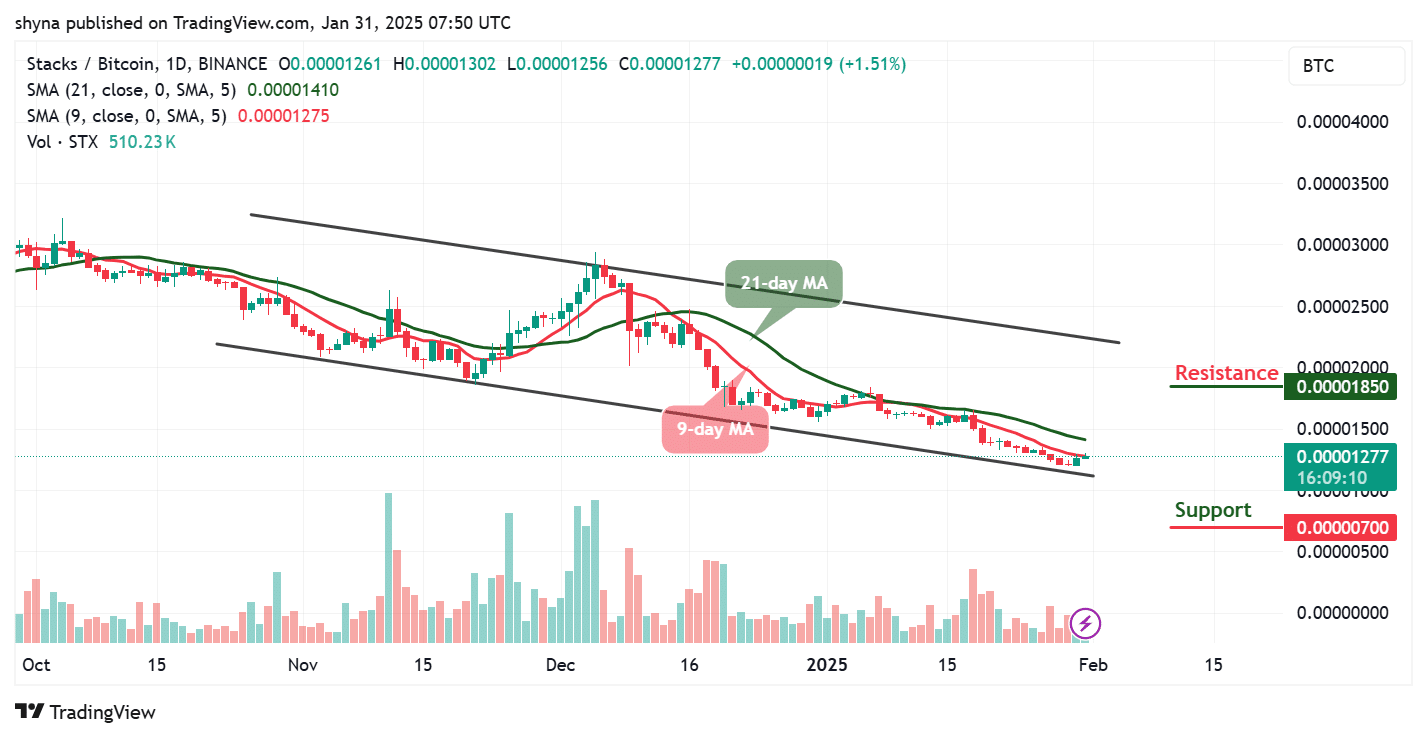

STX/USD Market

Main levels:

Resistance levels: $ 2.10, $ 2.20, $ 2.40

Support levels: $ 0.60, $ 0.40, $ 0.20

STX/USD currently shows a continuing direction in a convergence channel. The price is traded at $ 1.33, slightly higher than the lower boundaries of the channel, indicating that the market tests the level of decisive support. However, MA remains for 9 days (the red line) less than 21 days (green line), confirming the continuous declining momentum. Therefore, if the price fails to collapse over the MA for 9 days, sellers may push the price to less than the main support at $ 1.00, which corresponds to the lower directional line of the channel. Strong downward closure can lead down this level to more negative movement, extending the losses to deeper price areas.

Prices predict

The stack price (STX) is about an average of 9 days and 21 days at $ 1.33. On the upper side, there is an opportunity to apostasy in the short term because the price is near the historical support zone. If buyers gain momentum and the price is closed over 9 days, the next goal will be MA 21 days, currently about $ 1.43. A successful collapse that exceeds this moving average indicates a potential trend, which leads to a re -test of the main resistance level at $ 2.0. However, any other emerging movement can reach the levels of resistance amounting to $ 2.10, $ 2.20 and $ 2.40.

However, the STX/USD market expectations remain declining unless the MA erupted for 21 days and the descending trend line occurs. If the price remains less than these resistance levels, the probability of testing the support is at $ 0.60, $ 0.40 and $ 0.20. Meanwhile, merchants should monitor prices near the current support area and monitor whether MA is for a 9 -day resistance or is breached to the upward trend. A decisive step in either direction will be determined whether STX continues the declining direction or begins to form a bullish restoration pattern.

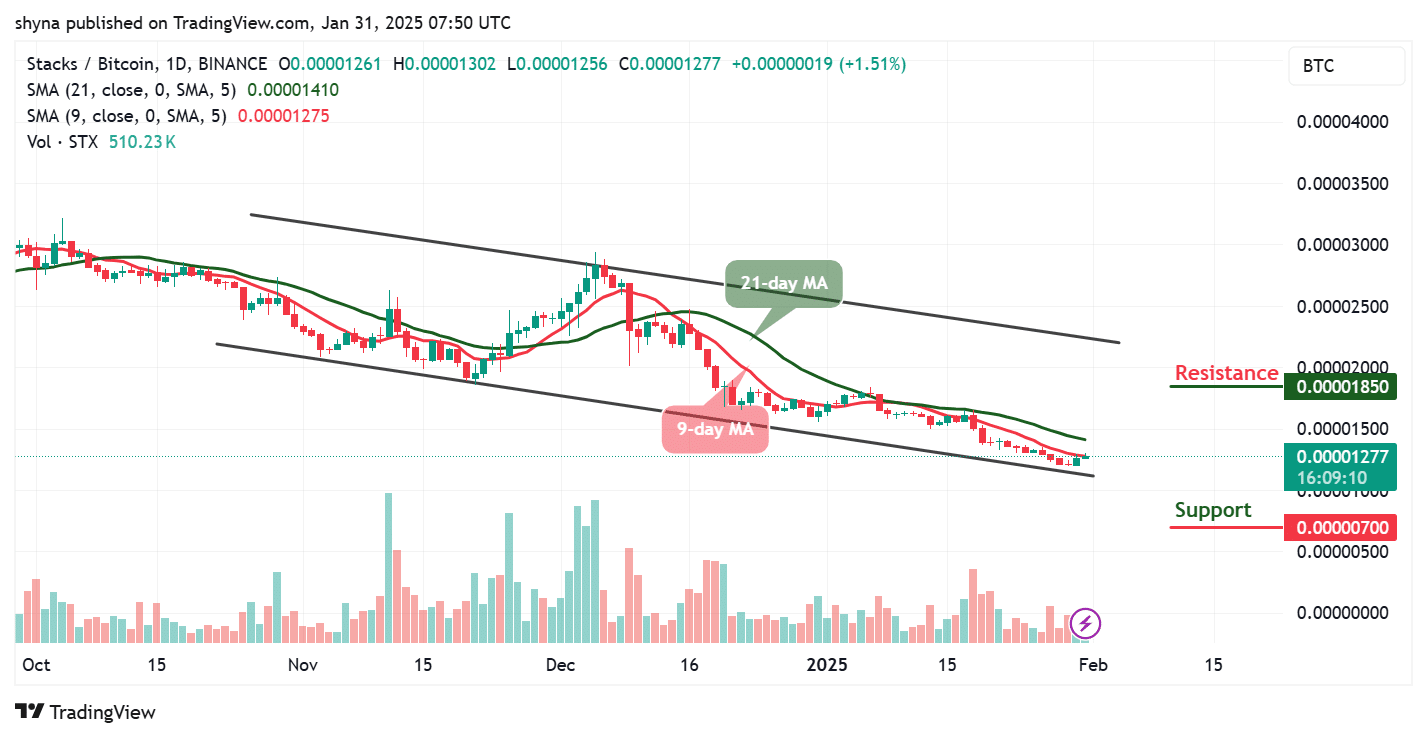

STX/BTC may cross at the bottom of the direction line

The Daily Stx/BTC chart continues to trade within a convergence channel, with the current price at 1277 SAT. The market remains declining as MA for 9 days (1275 SAT) is less than MA for 21 days (1410 SAT), which confirms the declining pressure. However, the price near the lower boundaries of the channel, indicating a possible support test at 700 SAT. If this level persists, a short -term recovery can be expected towards MA for 9 days or even MA for 21 days. However, the failure to maintain this support can accelerate the landfill and pay their prices.

On the upper side, in order for STX/BTC to be reflected in its current direction, the price must collapse over 21 days and target the following resistance in 1850 SAT. However, the bullish penetration of the condolence channel can indicate the shift of the direction, but the current volume levels remain weak, indicating a decrease in the purchase interest. If the bulls fail to keep the momentum, the declining direction may continue. Meanwhile, merchants should monitor how the price interacts near the support area and whether it can recover MA for 9 days as a preliminary resistance.

Moreover, INMORTALCRYPTO participated on X (previously Twitter) that $ STX caught their attention as the first qualified encryption project ever SEC, with a focus that with America’s driving the encryption space, it is possible that the US -based coins such as stack .

One of the main reasons $ Stx I caught my attention because it was the first qualified encryption project on SEC.

America will be at the forefront of Crypto, and the coins like Stacks will be superior, literally American currency, most likely.$ Stx pic.twitter.com/g0uat8Q3p8

– Inmortal (inmortalcrypto) January 21, 2025

Alternatives

Modern market developments indicate that STX is currently pressing inside the falling wedge, which can soon be resolved in collapse. If the price exceeds the highest resistance of this string, the technical goal will be about $ 3.50, which corresponds to the previous hacking goals. In other words, Wall Street Baby gained a large traction in the encryption market, raising more than $ 65 million in a period of $ 73 million. Compared to the US dollar, the $ US $ momentum refers to strong early demand, but the basic procedure after its launch will depend on the investor’s behavior.

This will not last – Wall Street Baby is likely to sell early

With daily flows of more than one million dollars, the demand is increasing, and the first investors put themselves to make enormous possible gains. The project has already attracted great attention from the holders of the previous successful symbols, as it showed strong support for society and confidence. With the high temperature of the encryption market, the WEPE appears with its unique brand, the growing ecosystem, and the upper feeling. Don’t miss – secure your position now before you sell government representation and $ Wepe launched on the main stock exchanges.

Visit Wall Street Pep

Related news

The latest Mimi ICO – Wall Street Baby

- Review by coins

- Pre -early arrival tour

- Alpha Special Trading for WEPE Army $

- Swimming pool – APY high dynamic

Join us cable A channel to stay in view of the coverage of urgent news