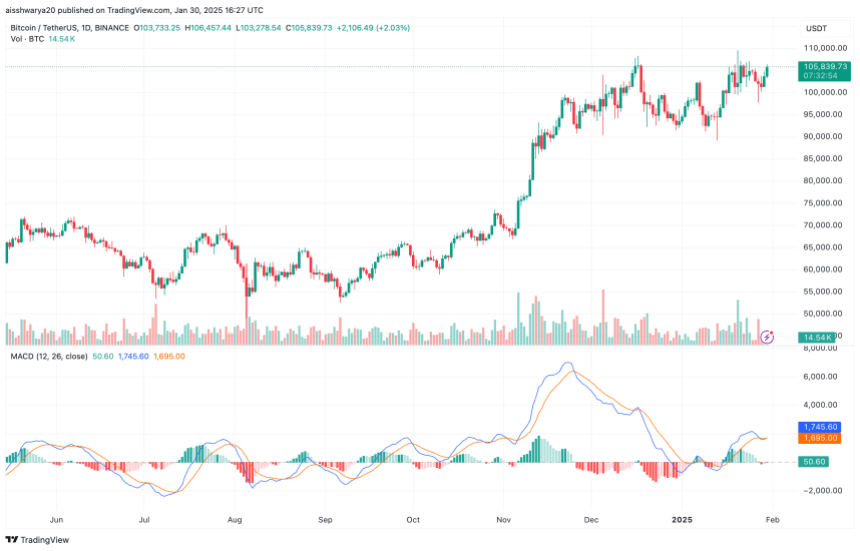

Bitcoin resists Deepseek Dip and FOMC volatility – how new is a new ATH?

Este artículo también está disponible en estñol.

In the past few days, Bitcoin (BTC) has withstood two main developments that could deviate from the route of the bullish momentum of the encrypted currency. Looking at the flexibility of Bitcoin, analysts are now expecting a new BTC at all (ATH) in the coming weeks.

Bitcoin challenges the sale of Deepseek, FOMC’s uncertainty

Earlier this week, American stocks achieved great success after Deepseek revealed the open source LLM, raising concerns about the high market evaluation of its American counterparts. As a result, the S&P 500 has seen strong sale, as NVIDIA led the losses, decreased by 16 % in one day.

Related reading

Likewise, at its last meeting, the Federal Open Market Committee (FOMC) left interest rates unchanged, in line with the market expectations. While the hardline situation was expected to deal with another blow to the encryption markets, BTC remained relatively safe after a preliminary decline.

At the time of writing this report, BTC is trading at $ 10,839, after it mainly recovered all its losses from the collapse of the market caused by Deepseek. In fact, the BTC has outperformed S&P 500 over the past five days, as it has increased by 1.53 %, compared to the latter’s decrease by 1.25 %.

New BTC ATH in February?

The BTC experienced coding dealer commented on the BTC power, saying that digital assets have stood well despite the disturbances. The trader added that they do not see any reason for the lack of BTC not to reach a new ATH soon.

Bitcoin fans, Castillo trading, male Bitcoin price structure “looks flawless”. They added that each of the low -time tires and the second indicates that BTC is likely to rise.

Related reading

In a similar context, the encryption dealer and businessman Michael Van de Bob He said The BTC ATH market is likely to witness a new “coming weeks”, and it may be hinted in February as a target month.

Moreover, the Roman Crown Traffic Trader shared the next scheme, Suspension “Stoch & Rsi has a large space to break the resistance of $ 108,000 and its head is higher. They added that the bullish difference on BTC also plays well.

For beginners, both Stochach and RSI are a momentum indicators that help traders to determine whether the basic basic principle is exaggerated or outperforms the current market conditions.

Although new BTC ATH expectations may focus in the short term, the market cycle peaks are expected To happen in the summer of 2025. For example, talk a report According to BitFinex expectations, BTC can rise to $ 200,000 by mid 2015, amid low prices.

At the same time Dibsic Expected BTC may lead between $ 500,000 and $ 600,000 by Q1 2026. At the time of the press, BTC is trading at $ 105,839, an increase of 3.1 % in the past 24 hours.

A distinctive image of Unsplash, X and TradingView.com plans