Persons ’Overview: PTC – PTC (NASDAQ: PTC)

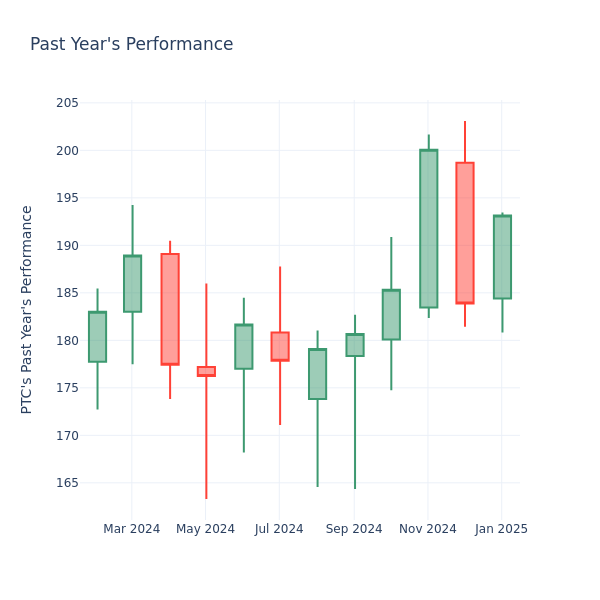

In the current session, the stock is traded at $ 190.23, after a 0.61 % He increases. During the past month, PTC Inc. PTC The shares have increased before 5.53 %And last year, by 8.06 %. With such performance, the long -term shareholders are optimistic, but others are likely to search for the price ratio to the profits to see if the stock has been estimated.

A look at PTC P/E in relation to its competitors

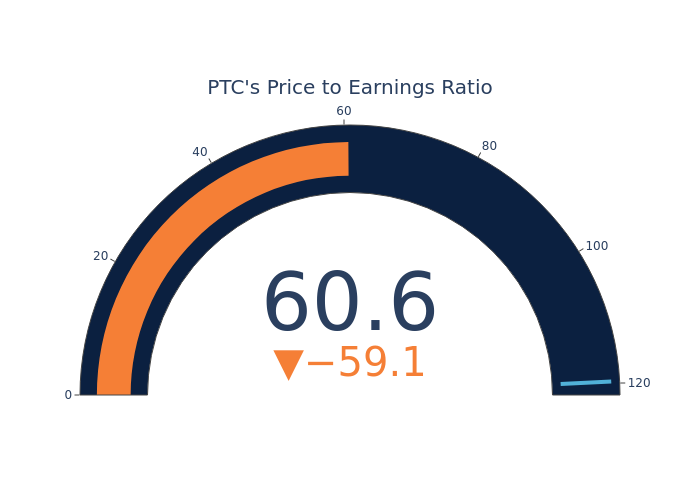

P/E measures the current share price to EPS for the company. It is used by the long -term investors to analyze the current performance of the company against previous profits, historical data and the total market data for industry or indicators, such as the S&P 500. P/E indicates that investors expect the company to perform the company is better in the future, and the stock may be exaggerated in it , But not necessarily. It can also indicate that investors are ready to pay a higher share price, because they expect the company to work better in the next seasons. This leads investors to remain optimistic about the high stock profits in the future.

Compared to the ratio P/E College 119.66 In the software industry, at PTC Inc. P/e ratio is less 60.6. The shareholders may tend to believe that the arrow may perform worse than its peers in the industry. Inventory can also be less than its value.

In conclusion, the price ratio to profits is a beneficial measure for the company’s market performance analysis, but it has its restrictions. Although the less P/E can indicate that the company is emerging with less than its value, it can also indicate that shareholders do not expect future growth. In addition, the P/E ratio should not be used in isolation, because other factors such as industry trends and business courses can also affect the company’s share price. Therefore, investors must use the P/E in conjunction with other financial scales and qualitative analysis to make informed investment decisions.

Market news and data brought to you benzinga Apis

© 2025 benzinga.com. Benzinga does not provide investment advice. All rights reserved.