58 % jump in Dogecoin (Doge) Trading Studay ‘

Every year on April 20, the Dogecoin (Doge) community is preparing for what has become known as “Dougraday”. This is not official, of course. There is no sponsor for companies, no sign on trading platforms, and no real event. But in the world of coins and encryption culture, Douageay is something-a celebration on the Internet rooted in the date of the MEME 4/20 calendar and the assets of the joke fed.

And this year, Dougrade brought more than jokes. I brought the numbers.

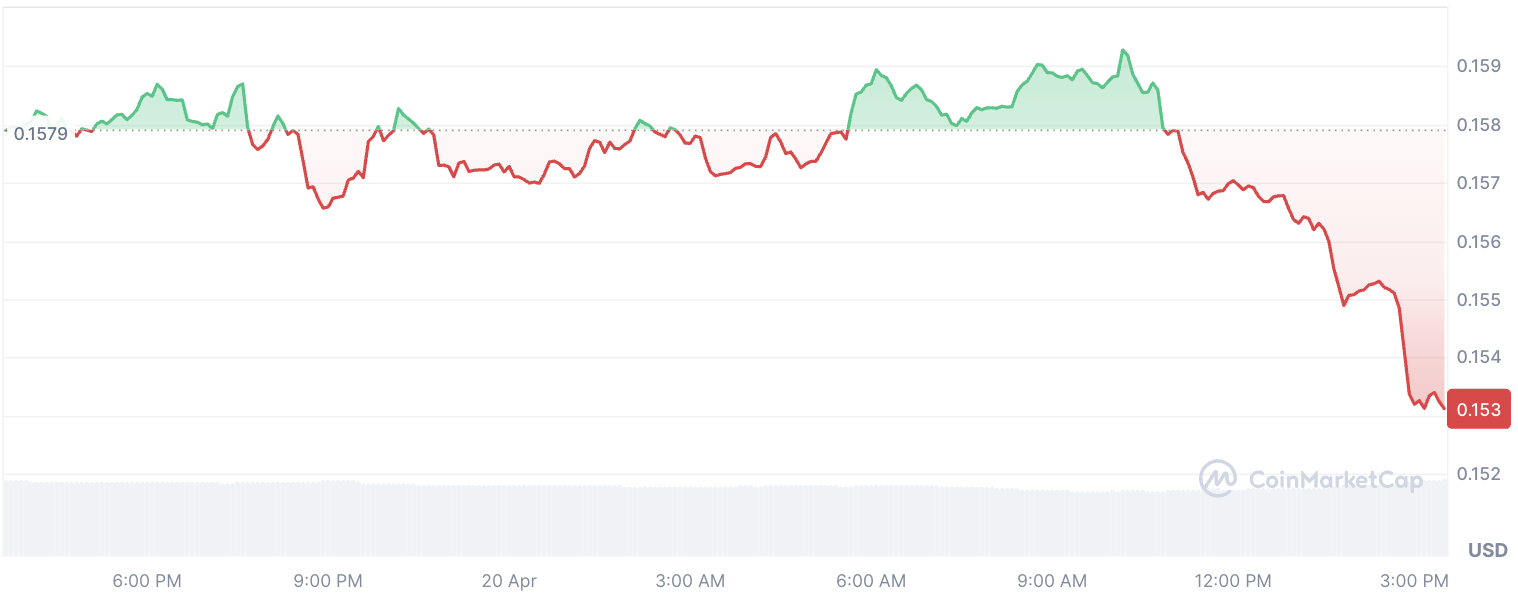

Although Dog is spending most of the day sliding in the plans – from about $ 0.159 early from the session to less than $ 0.153 by the afternoon – the derivative traders decided to illuminate things anyway.

according to CoinglassThe open interest on the options jumped by 58.51 %, while the size exceeds twice, as it increased 116.11 %. What can be completed in a nutshell-current positions were mixed strongly, but the appetite for speculative in the short term was very real.

Through the main stock exchanges, the long/short bullish ratio bent. Traders expected to wear Douagey, but what they got instead was a somewhat brutal decline, and about $ 2.75 million in the rank. Longzz got the strike, as more than two million dollars were eliminated within 24 hours.

So what exactly happened? Feelings ran before the price, again. Douheday may have sparked enthusiasm, but there was no follow -up. No incentive. Just a momentum fades in the afternoon and a market full of merchants was wrong.

However, this type of speculative height – especially when it comes with the flow of heavy options – usually means one thing: the volatility is coming. Either we see a short -term bounce where these situations are re -downloaded, or the market continues to relax and drift drifting during noise reset.

So, will Dogecoin recover from raw dougeday? This is the question now.