NIFTY 50 hovering around the psychological levels of 25000

- What is the next for the NIFTY 50 index. Check the technical analysis and the main basic factors that affect the price movements at the present time

During this week, the Indian markets have witnessed a strong step with record indicators that have gained more than 4 % in the last four sessions. Let’s see the main factors that lead the Monday gathering:

- The ceasefire agreement between India and Pakistan

- Optimistic advertisement related to the commercial deal between the United States of China.

- News of the upcoming peace talks or Ukraine to be held on May 15.

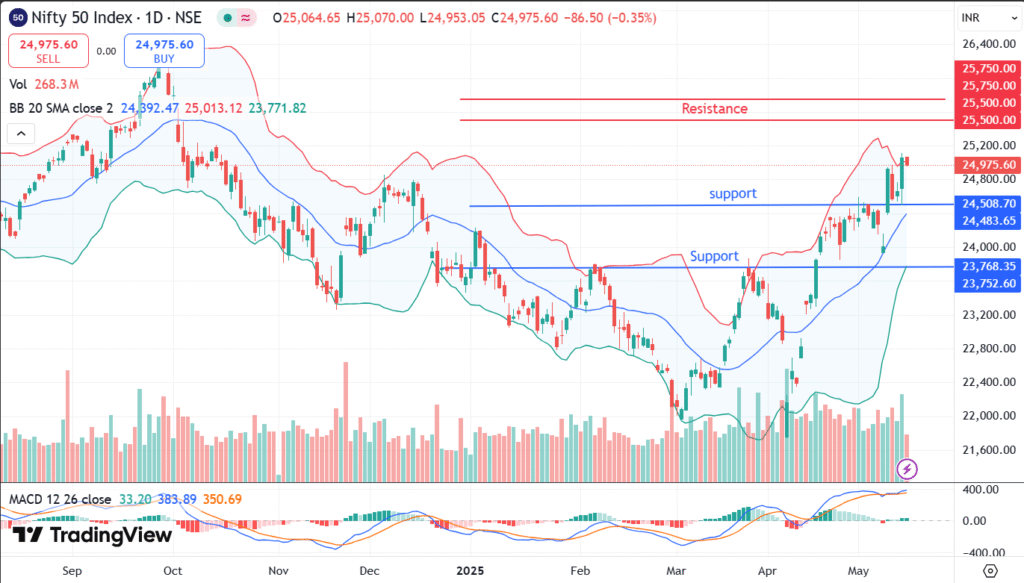

Starting this week, the market distinguishes a strong observation and generated a higher outbring of unification range (24500-23848), indicating the movement’s resumption up.

On Tuesday, NIFTy witnessed 50 profits about the psychological levels of 25,00 and tested the 24500 penetration area on Wednesday. However, NIFTY resumed 50 steps higher and reached a new weekly level of 25116 in Thursday’s session.

Technical levels of the NIFTY 50 index:

Technically, it is highly advised to the upper trend of the NIFTY 50 index. Any clear daily closure may open above the resistance level of 25284 the door for buyers to pay prices towards the level of 25,500 in the coming weeks, which will open the road to reach 25750, because the levels of 24500 and 24400 are likely to serve as major support.

On the other hand, if the price is unable to maintain its strength above 25,000 levels, it may open the way for prices to reach lower levels because in this case, the level of 24,800 will be a strong resistance instead of support. This elegance may raise 50 down to the support level 24500.

The main main factors that affect the NIFTY 50 indicator:

Macroeconomic factors:

GDP growth: The higher the growth rate of GDP, the greater the possibility of leading corporate profits to increase, and therefore, this will positively affect the NIFTy 50 index.

See too

India’s monetary policy: The higher the interest rate, the higher the costs of borrowing for companies, and it reduces consumer spending. So the appetite that must risk will be less, and the stock investment will be less attractive to investors, so it will negatively affect NIFTY 50, and vice versa.

Companies profits:

The total profitability and the growth of the companies listed in NIFTY 50 affect the price movements of the index. If companies have a positive profitability, this may affect the indicator positively and vice versa.