Sol PRICE owns $ 200, as whale activity slows down

Solana (SOL) is hovering near the level of $ 200, as it tries to the maximum market for a trading mark of $ 100 billion and daily trading in the amount of 4 billion dollars. Meanwhile, the number of whales from Solana decreased after reaching the highest level ever at 5,167 on January 25, and he is now sitting at 5,067.

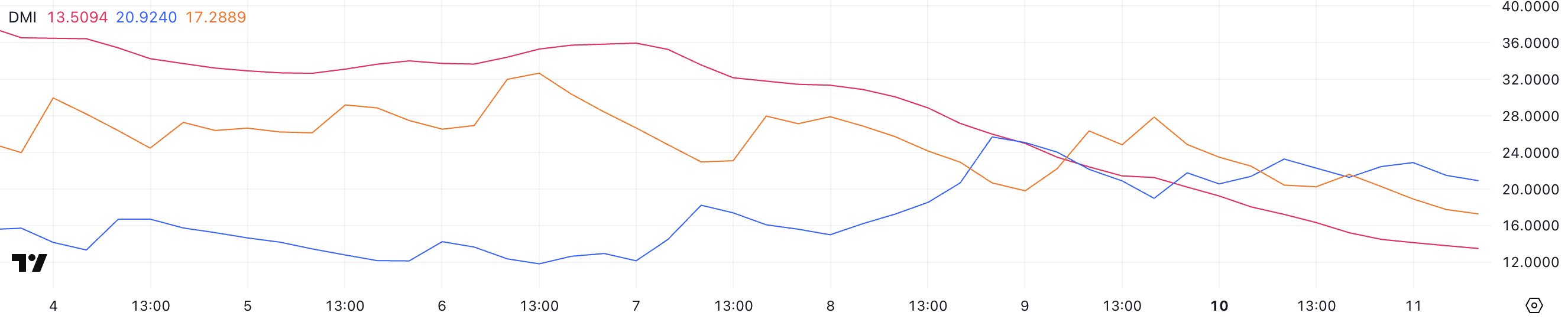

This shift in whale activity, along with the weak direction strength in DMI and the narrowing of EMA lines, indicates that Sol is at a critical point, with both the upscale and dramatic scenarios in play.

Solana Whales decrease after reaching its highest levels ever

The number of Solana Whales-headings bearing at least 10,000 Sol-climax at a level higher than 5,167 on January 25 before it begins to decrease. While there was a brief recovery to 5,131 on February 4, the number continued to decrease, now standing at 5,067.

Monitoring the activity of these older bearers is very important, as whales play a major role in market trends. Its accumulation can indicate confidence and a possible increase in prices, while the decrease in whale cans may indicate distribution, which increases the risk of selling pressure.

Although the number of the current whale is still relatively high compared to historical levels, it is close to the lowest point last month. This indicates that some of the big bearers may reduce their exposure, which may provide volatility if the trend is accelerating.

However, the total number is still high, which means a large whale in the market. Whether this trend continues down or settles it will be a major factor in determining the next main Solana move.

Solana DMI shows the sale of the sale, but the oriental pressure remains weak

The Solana DMI chart shows a sharp decrease in the strength of the trend, as ADX has decreased to 13.5 from 31.5 during the past three days. ADX, or an average trend index, measures the strength of the direction, with readings above 25, usually indicates a strong direction and values less than 20, which indicates the momentum of the weak or non -existing direction.

With ADX now less than 20, it indicates that Solana’s last trend has lost strength significantly, leaving the market without a clear directional bias.

Looking at the directional indicators, the Di +in 20.9 has fluctuated between 19 and 23 in the last two days, while -Di decreased from 27.8 to 17.2. This indicates that the declining pressure has decreased significantly, but the bullish momentum has not strengthened enough to create a clear upward trend.

With the approximation of both indicators and ADX at very low levels, Solana is currently in a stage of monotheism instead of the decisive direction. Until a stronger directional step appears, Sol PRICE may continue to trade sideways, waiting for a catalyst to determine its next step.

Sol prediction: Will Solana test 220 dollars soon?

The Solana Prices Prices indicate that EMA lines are narrowing, indicating a decrease in momentum and the absence of a clear direction. In the event that the bullish momentum is returned and the upper trend develops, Sol PRICE can first test the resistance level of $ 220.

The collapse above this may increase the gains, which may push the price to $ 244, which is its highest level since the end of January.

On the other hand, if the declining direction appears and enhances, Sol PRICE can re -test its main support at $ 187. The rest of this level will reveal the price alongside the negative, with the possibility of declining to $ 176, which represents a 12.5 % correction.

This scenario indicates that the sellers have obtained control, which increases the possibility of continued decline. As EMA lines continue to converge, the market remains unpopular, and the next step will depend on whether buyers or sellers take the initiative.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.