3,750% Liquidation Imbalance Stuns XRP Bulls

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not responsible for any financial losses incurred while trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content to be accurate as of the date of publication, but some offers mentioned may no longer be available.

There have been some unusual trading patterns in XRP perpetual futures lately. According to liquidation data, there is a huge difference of 3,750% between long and short positions. Queen Glass Data shows that in just one hour, more than 97% of the $500,000 liquidated in XRP futures came from the long side, leaving just $14,000 tied up in short positions.

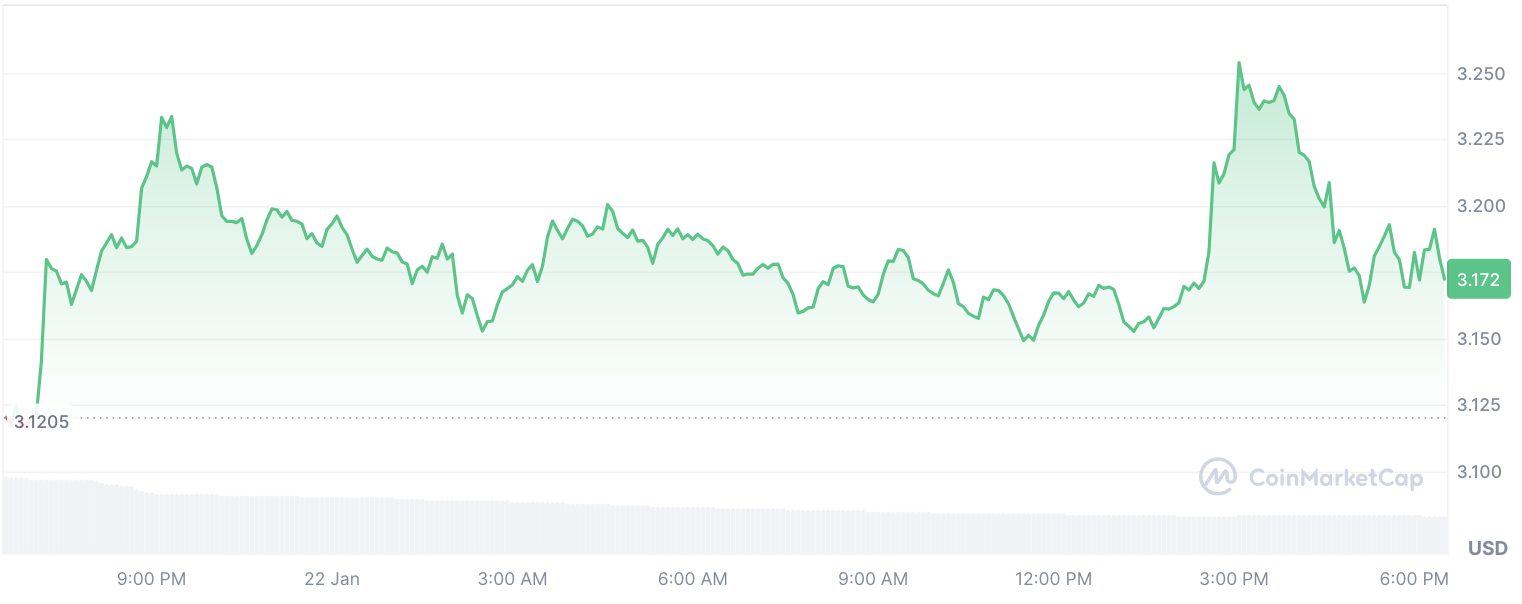

This significant divergence occurred at the same time as a slight 1.5% decline in the price of XRP. The previous 2.3% gain in the cryptocurrency’s value had traders feeling complacent, so they took aggressive buy positions.

But then, everything changed very quickly, leading to a host of liquidations. This showed that some strategies were very risky because they were overpriced, and some were not well managed.

The same phenomenon is happening in the rest of the cryptocurrency market. In the last 12 hours, liquidations across digital assets totaled $79.28 million. Long positions accounted for $53.25 million of this amount, far exceeding the $26.04 million in short liquidations.

January hits different

For XRP, the significant imbalance shows a lot of overconfidence in the market and reliance on momentum trading.

While many people expect the market to continue to rise at the start of the year, events like this show how fragile this type of thinking is. November’s rally had us thinking that January would be strong, but it’s important to remember that markets can change quickly and catch traders by surprise.

The fact that long positions are the most affected when it comes to liquidation shows that the cryptocurrency markets are feeling very optimistic. But, as with other crypto assets, XRP remains quite volatile.