Data signals on the series Solana key test at the level of $ 135-vision

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Solana has been fighting since late January, when she witnessed a sharp decline alongside the broader encryption market. Sol has lost more than 60 % of its value, as it is now fighting the bulls to keep the current price levels. Analysts are still skeptical, calling for a continued declining direction while Solana is struggling to restore higher levels.

Related reading

Despite negative feelings, some investors are optimistic about the rapid and strong recovery in the coming months. They argue that market conditions can turn quickly, especially if the broader economic factors and liquidity conditions improve.

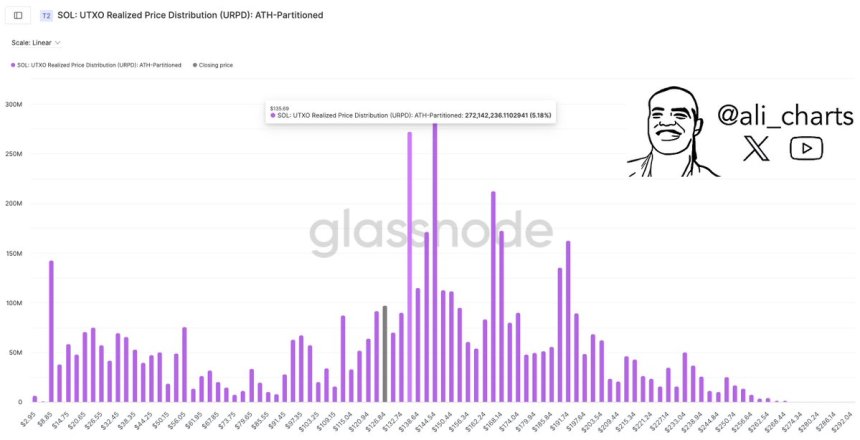

The data on the series from Glassnode reveals that Solana is facing a major test, as $ 135 is the most important resistance level according to the Utxo (URPD) price distribution index. This scale determines the main price levels as large amounts of Sol have changed before, making $ 135 a critical level of price.

If Sol managed to break it and increase $ 135, it may indicate the reflection of the direction and open the door for a possible recovery. However, the failure to restore this level can lead to more negative side, which enhances the hybrid view. The coming weeks will be very important to determine the next main step for Solana.

Solana is struggling under the main resistance where the bears control

Solana was traded under heavy pressure pressure, and was struggling to restore the main levels after weeks of uncertainty in the market. The bulls have lost control as soon as the Seoul decreased to less than $ 180, and now speculation is increasing around the long bear market. The price remains less stuck than the main resistance, making the challenge to recovery.

Senior analysts Ali Martinez shared visions on xHe revealed that Solana is facing a major test at the level of $ 135, which was determined as the most important resistance based on the UTXO (URPD) price distribution index.

The URPD is a scale on the chain that tracks the price levels that have been transferred again. It highlights the important areas of accumulation, which shows the place where investors bought and selling them previously. When many symbols have changed at a specific price, this level becomes a decisive support or resistance area.

In the case of Solana, $ 135 represents a level in which a large amount of Sol was treated. This means that if Bulls regains $ 135, this may be a strong support and indicates the reflection of the direction. However, if Sol fails to break it, the bears may enhance the pressure pressure, which leads to more negative side.

Related reading

Solana faces the main support test at $ 126

Solana (SOL) is trading at $ 126 after exposure to a massive sale pressure in recent weeks. The price was in a strong declining direction, and it failed to restore the main levels with the uncertainty and fluctuation at the market level continued to push the morale.

Currently, Sol sits at the level of decisive weekly demand, which the bulls must defend if they want to start a recovery or at least create a standardization stage around the current prices. The contract of this support can provide the relief equipment, but the market is still fragile.

If the Sol loses the level of $ 120, the sale pressure may increase, which is likely to send the price about $ 100 or even less. A break below this demand area may indicate more weakness and can lead to the sale of panic, which leads to deeper losses in the Altcoin market.

Related reading

For any meaningful recovery, bulls need to pay a Sol above $ 135 and recover $ 150 to change the momentum in their favor. Until then, the negative risks remain high, and traders will closely monitor how Solana interacts with this critical support level in the coming days.

Distinctive image from Dall-E, the tradingView graph