29.02 % of closed signals in the long run

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

ETHEREUM is traded at a critical level after a mark of $ 2400, which indicates flexibility in the face of fluctuations at the market level. The bulls managed to defend the main support levels in a newly fake after $ 2200, but the momentum is still fragile as a moral joke to establish a clear direction. Despite attempts to pressure on top, the price procedure is merged near the medium term, indicating the frequency between merchants. However, the basic power continues to build under the surface.

Related reading

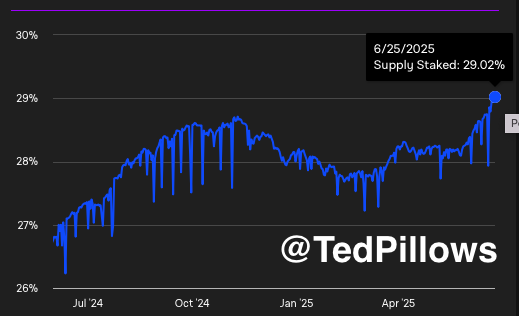

The best analyst TED Bodes highlighted the chain: the percentage of ETHEREUM, which is running to the highest new level ever, has reached. This prominent monuments indicate a high confidence between their holders and long -term fighters, who are increasingly imprisoning ETH to secure the network and gain the return. The historically high returns levels coincide with low active supply and reduce sales pressure – an encouraging sign of expected bulls.

As overall economic uncertainty and geopolitical risks, ETHEREUM behavior at this level can determine whether the broader Altcoin market finally indicated. Currently, ETH is located at a technical and psychological crossroads, where both bulls and bears are preparing for the next main movement. All eyes are on the curtain data and the price structure to direct what comes after that.

Ethereum builds a bullish momentum as it hits Stokeing high all the time

Ethereum rose 75 % of its lowest level in April, showing a strong recovery and flexibility in a volatile market. Despite this impressive recovery, ETH is still less than 98 % almost its highest level ever, leaving great upward potential. Many analysts believe that Ethereum can prepare for a crowd that may lead to a long -awaited altseason. However, caution remains in the market due to the ongoing global risks and total economic certainty, including high interest rates and geopolitical tensions.

The increased optimism is supported by improving the basics of the chain. Ted pillow highlighted As for a major scale, it shows that the percentage to supply Ethereum Stapled has reached the highest new level ever at 29.02 %. This fixed increase in ETH Staked reflects a long long condemnation of my holders, who choose to imprison their assets to support the network and earn the return instead of selling during the market turmoil.

Historically, high levels of savings reduce the active circulating supply, which can reduce the sale of pressure and upward fuel price movements. In conjunction with the technical power and the growing confidence among the long -term investors, the ethereum appears to be a good position for collapse, provided that the bulls retain current levels and restore the resistance areas.

Related reading

ETH restores the main level but faces resistance

ETHEREUM (ETH) shows a renewed force after its bounced from its lowest levels in April 2025 and the restoration of $ 2400. On the weekly graph, the ETH rose more than 10 % this week, closing with a minimal moving average for 200 weeks (SMA) at $ 2,437.52-a major threshold that was previously behaving as resistance and support in previous sessions. The restoration of this level is a thunderbolt and it appears that buyers return after months of pressure.

However, Ethereum is now facing great resistance around the $ 2625-260 region, where SMAS is converging for 100 weeks and 50 weeks. This region was historically as the axis of the main price procedures, and a clear break on it will probably lead to a wider crowd targeting a range between the ages of 2,800 and 3000 dollars.

He also chose the size, which indicates a renewed interest, although it remains less than the first levels of 2024. This indicates cautious optimism between merchants, especially since uncertainty in global macro and geopolitical tensions still inspect the markets.

Distinctive image from Dall-E, the tradingView graph