13,520 % balance in Bitcoin (BTC) on Easter

It is not a kind of credit for Easter who were hoping, as during the past four hours, Bitcoin (BTC) has seen a 13520 % liquidation, with $ 9.62 million in a long period compared to only $ 71,000 in short pants. This step came amid a sharp decrease in the BTC price to its lowest level near 83,800 dollars before the moderate bounce to the current level of $ 84,453.

The sales process has liquidated a total of $ 35.35 million across the market in the same window that takes four hours, with 83.6 % of the long damage.

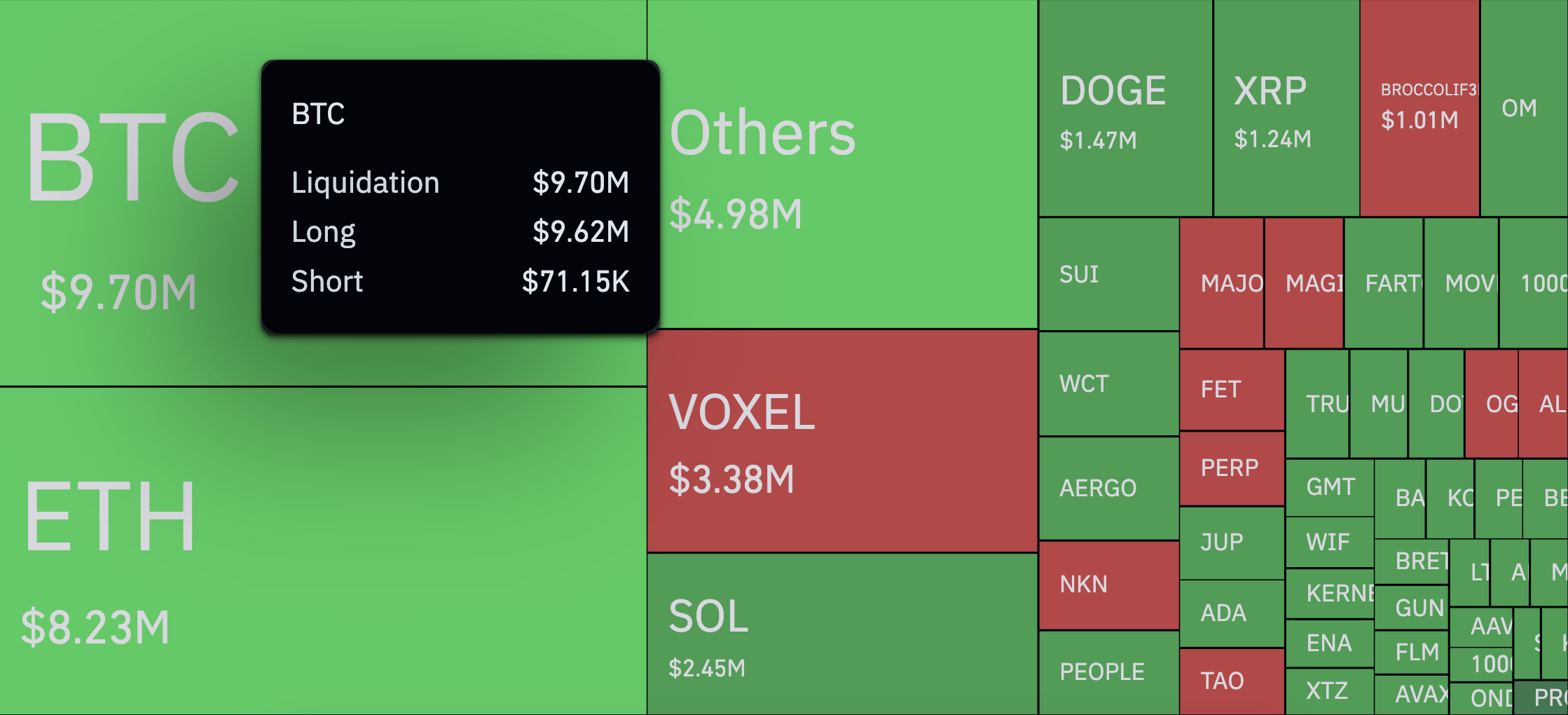

The BTC alone formed the largest piece of $ 9.7 million, followed by ETH at 8.2 million dollars and Sol with $ 2.45 million in the farewell leverage.

The size of the defect talks about itself. Although the long qualifiers are common in rapid decline, this type of flow in one direction-more than 130 times has been liquidated more than short pants-shows the extent of the market at the weekend. The fluctuation has been sufficient to pay a total of $ 165.1 million in liquidation over the past 24 hours, affecting more than 119,000 traders.

The largest liquidation request? $ 5.95 million BTC/USDC on Binance, according to Coinglass.

If you look at the Bitcoin price scheme, you will see that this step was very slope but fast. After spending some time at about 85,400 dollars, Bitcoin took a decrease and decreased by about $ 83,800. The rapid reflection indicates excessive excessive term, but the damage to the long positions that have already occurred has already occurred.

Traders on Easter came on Sunday, believing that the market would rise. What they got was a brutal reminder: When everyone goes in the same way, even a little payment in the other direction can lead to a total survey.