$ 100 million in short pants indicates that Solana may not cross $ 235

Amid the continuous decrease in the market, Solana (Sol) acquires attention from encryption enthusiasts due to its current work in the daily time frame. On January 29, 2024, what when the Blockchain document was published on X (previously Twitter) that the encryption whale has moved 220,30,308 Sol at a value of $ 52 million.

The encryption whale transports 52 million dollars from Seoul

This large quantity of Sol from Bitfinex Cryptocurrency Exchang was transferred after the opening bell of the US market. However, analysts and experts look at this treatment as accumulation by the whale as the assets suffer from a significant decrease in the price.

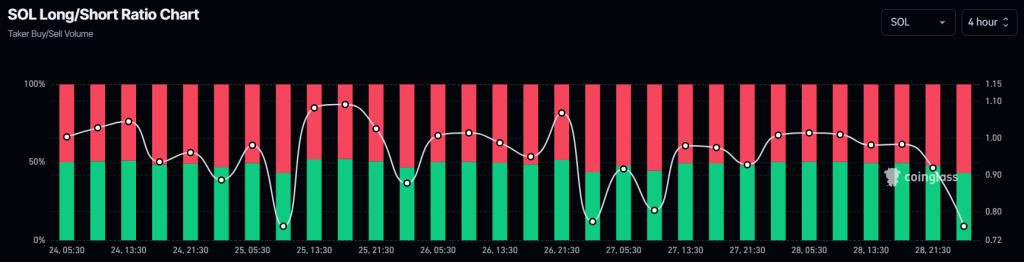

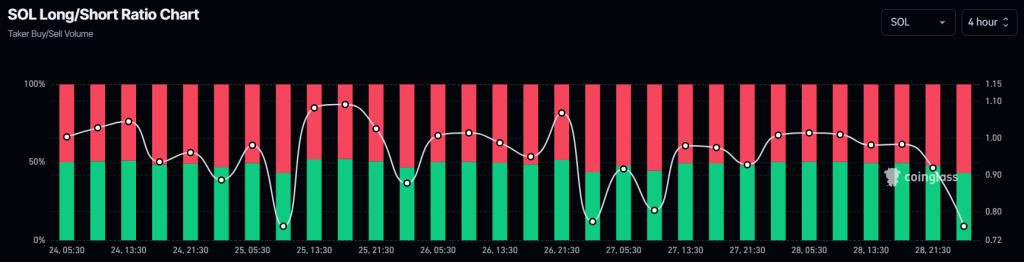

Despite the potential accumulation of the whale, the Sol price has continued in its declining course, struggling near 227 dollars with a decrease of 2.56 % in the past 24 hours. According to the data on the series of Coinglass, the feelings among merchants are still strong, with a long/short percentage of 0.77. This indicates that 57 % of senior merchants hold short positions, compared to 43 % with long jobs.

Feelings of powerful, vast traders

However, the participation has not only decreased, but it seems that the traders during the day are betting on the short side, as the Analysis Company revealed the series Coinglass.

At the time of the press, the long/short/short percentage is 0.77, indicating a strong feeling of landing among merchants. Other data reveals that 57 % of the best Solana traders occupy short sites, while 43 % occupy long jobs.

When combining these scales on the chain, it seems that the long -term potential holders are accumulating, taking advantage of the current prices. Meanwhile, traders during the day seem to benefit from the dominant market morale, which leads to noticeable stakes in short locations.

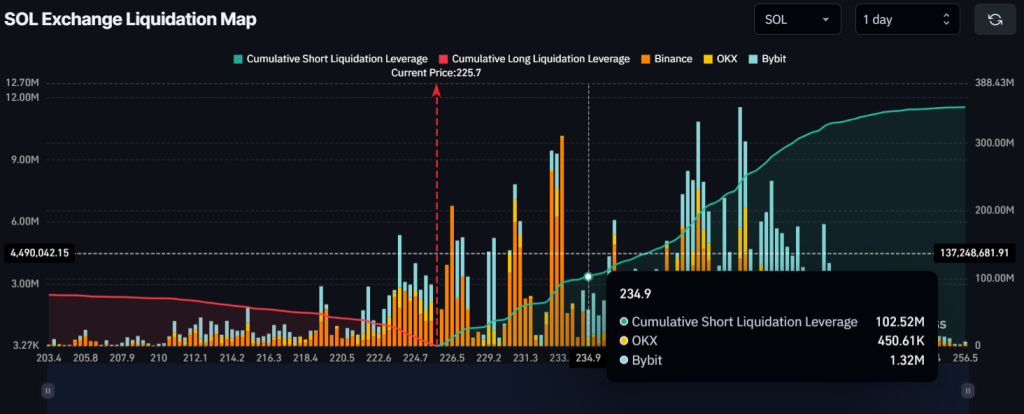

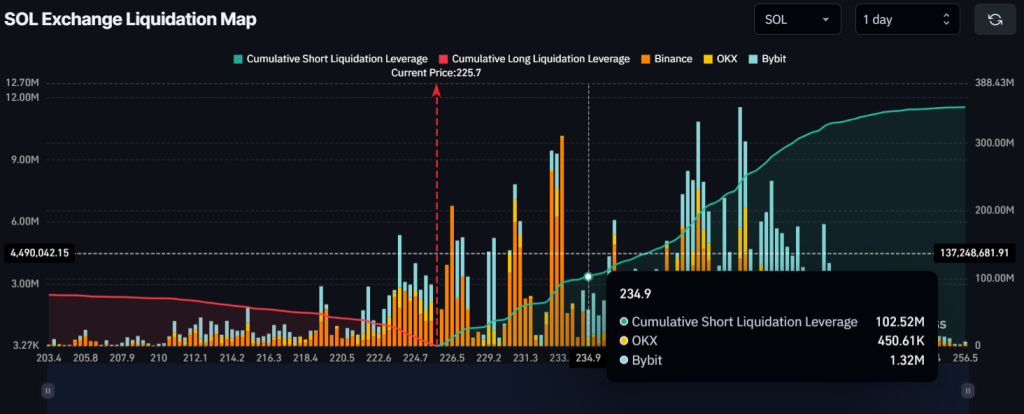

$ 100 million from Sol short centers

The current market’s feelings seem to be dirty, as short sellers hold more than $ 100 million of bets in short positions at $ 235.

Meanwhile, it seems to be exhausted, with only $ 40 million in long positions at $ 215, which can be easily filtered if the feeling remains unchanged and the prices continue to decline.