1 year after half of Bitcoin: What is different this time?

Bitcoin (BTC) is now one year after the last half, and this course is formed unlike any before. Unlike the previous sessions followed by explosive marches, BTC has witnessed a much greater muffle, an increase of only 31 %, compared to 436 % on the same time frame in the last session.

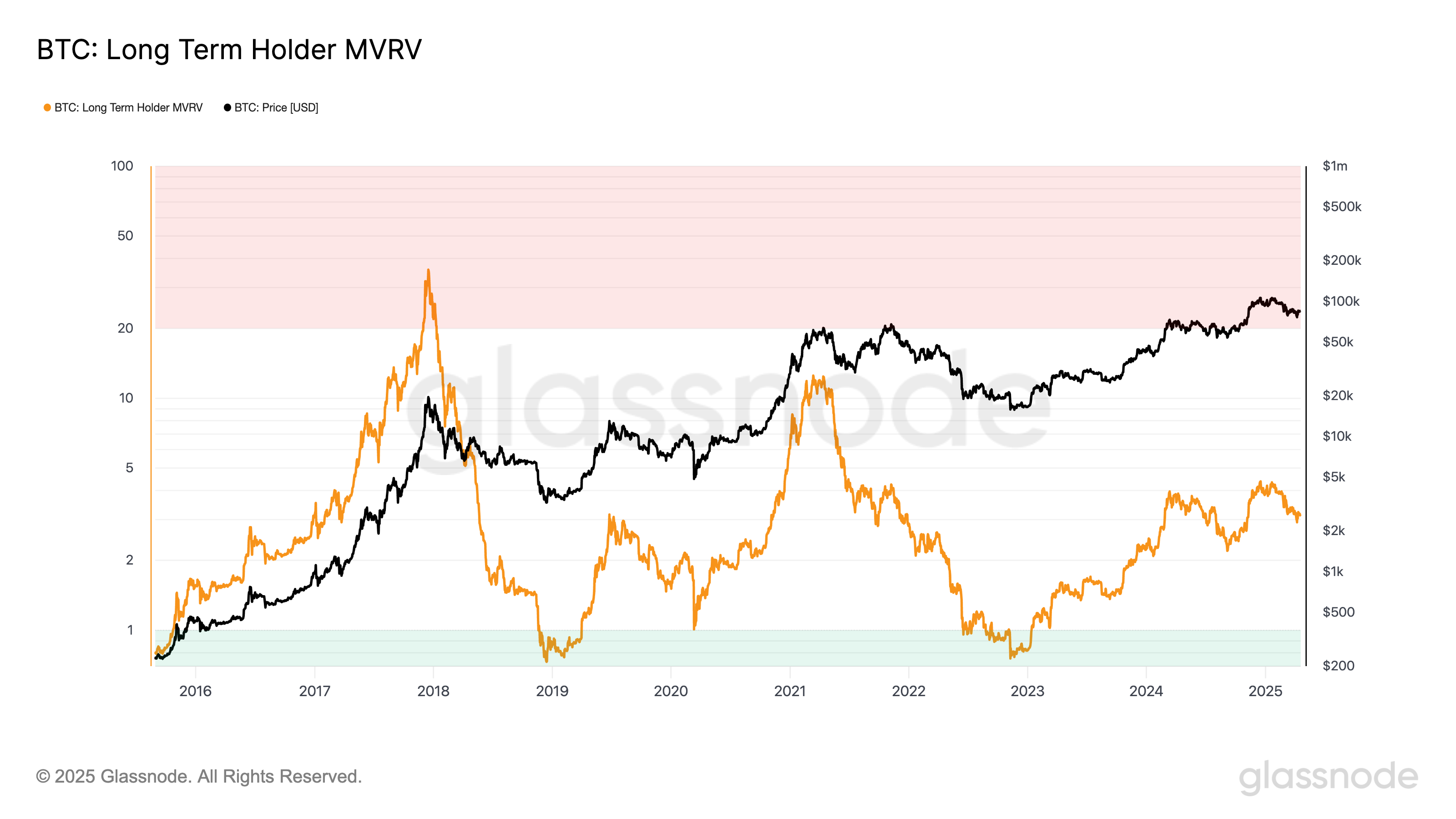

At the same time, long -term standards such as MVRV indicate a sharp decrease in unreasonable profits, indicating a ripening market with bullish pressure. Together, these transformations indicate that Bitcoin may enter a new era, which is defined less through the bonus peaks and more through the gradual growth that the institution is driving.

A year later in half

This Bitcoin cycle is noticeably different from the previous one, indicating a potential shift in how the market responds to half events.

In previous sessions – in particular from 2012 to 2016 and again from 2016 to 2020 – Pitcoin tends to gather strongly around this stage. The post -half period is often characterized by a strong upward momentum and the work of equivalent prices, and it is largely nourished by the enthusiasm of retail and speculative demand.

The current cycle, however, has taken a different road. Instead of accelerating after half, prices began to rise earlier, in October and December 2024, followed by monotheism in January 2025 and corrected in late February.

This front -loaded behavior is sharply different from historical patterns where Halvings usually served as a catalyst for the main gatherings.

Several factors contribute to this transformation. Bitcoin is no longer just speculative assets that depend on retail-merely, so they are increasingly considered a mature financial tool. The increasing participation of institutional investors, along with macroeconomic pressure and structural changes in the market, led to a more complicated and complicated response.

Another clear sign of this development is the weak strength of each consecutive cycle. Detrievance gains in the early years have become more difficult to repeat them as the maximum Bitcoin market grows. For example, in the 2020-2024 cycle, Bitcoin increased by 436 % one year of half.

On the other hand, this session witnessed a modest increase by 31 % over the same time frame.

This transformation may mean that bitcoin enters a new chapter. One with wild fluctuations and more stable and long -term growth. Half may not be the main driver. Other powers take over – trips, liquidity and institutional funds.

The game changes. Also, the way Bitcoin moves.

However, it is important to note that previous sessions also have also emerged periods of monotheism and correction before resuming their upward direction. Although this stage may seem slower or less exciting, it may still represent a health reset before the next transition.

However, this possibility remains that this course will continue to deviate from historical patterns. Instead of the top of the dramatic explosion, the result may be for long periods of time and structurally supported by noise, and more by basics.

What MVRV reveals in the long term about the bitcoin market ripening

The MVRV ratio (LTH) has always been a strong scale of unreasonable profits. It shows the amount of investors in the long run before the start of the sale. But over time, this number decreases.

In the 2016-2020 course, LTH MVRV reached its peak at 35.8. Which indicates the profits of huge paper and the formation of the highest clear. By the 2020-2024 cycle, the peak decreased sharply to 12.2. This happened even when the bitcoin price reached its highest level ever.

In the current cycle, the top of MVRV LTH so far is only 4.35. This is a tremendous decrease. It shows that long -term holders do not see the same type of gains. The trend is clear: Each course provides smaller complications.

Bitcoin explosive trend is pressure. The market is ripe.

Now, at the current cycle, the highest MVRV LTH reading was 4.35. This blatant decrease indicates that long -term holders suffer from much lower complications on their property compared to previous sessions, even with a large estimate of prices. The pattern indicates one conclusion: Bitcoin’s bullish direction is pressure.

This is not just a coincidence. With the ripening of the market, it is difficult to achieve explosive gains. The days of the audited profit complications may fade on the course, and the most moderate growth is replaced-but it is likely to be more stable.

The maximum increasing market means that it takes more capital to move the price significantly.

However, it is not a final evidence that this course has already been released. Previous sessions often included long periods of side movement or modest retreat before reaching new levels.

With institutions playing a greater role, the accumulation stages can extend for a longer period. Therefore, achieving peak profit may be less surprising than in previous sessions.

However, if the direction of the decrease in the MVRV peaks continues, it may enhance the idea that the bitcoin currency is moving away from the wild and periodic tyrants and a quieter but organized growth pattern.

The sharp gains behind them may be already, especially for those who enter late in the cycle.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.