$ 1.2 billion in ETHEREUM withdled from CEXS – a strong accumulation signal

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

ETHEREUM is gaining momentum again after marking $ 2739 and putting the highest new local level, reaching prices that have not been seen since late February. The assembly represents a strong return to ETH, which was subjected to great pressure earlier this year. Now, the bulls appear firmly in control as the broader encryption market and capital flows wake up to Altcoins.

Related reading

Analysts call for potential altseason, fueled by ETHEREUM’s relative power against Bitcoin and the increasing investor confidence. With Bitcoin mergement near the high levels at all, ETHEREUM seized the opportunity to outperform performance, raising the main resistance levels with condemnation.

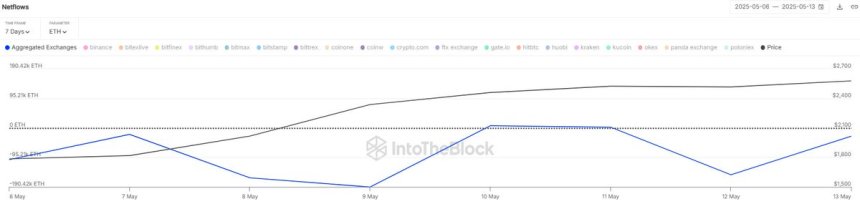

Support for this narration, the Sentora data (previously InToteblock) reveals that $ 1.2 billion from ETH was withdrawn from the central stock exchanges during the past seven days. This continuous trend of net external flows indicates the continued accumulation and low pressure side pressure, both strong signals of the long -term bullish momentum.

By heating prices and changing investor feelings, Ethereum can prepare for the main penetration. If Bulls maintain control, the area of 3000 to $ 3,100 may be tested in the coming days as the next main resistance area. All eyes are now on ETH where Altcoin market shows signs of life.

Ethereum builds momentum as accumulation of external flow signal

ETHEREUM is traded higher than critical levels with continuous growth gathering speculation. After weeks of slow movement, ETH returned to life, as it gained value of more than 50 % since last week. This sharp move to the upward trend has sparked hopes for Altseason, where many analysts have seen Ethereum as a potential operator of the wider Altcoin market.

ETHEREUM now maintains a power of $ 2,600, a level that has been a strong resistance for several months. This penetration, in addition to increasing momentum against bitcoin, indicates that the bulls are preparing to control. Traders closely watch the following main resistance area between $ 2900 and $ 3100, which can serve as a major test for ETHEREUM order.

In addition to the upscale issue, Data from Sentora It reveals that $ 1.2 billion has been withdrawn from ETH from the central stock exchanges during the past seven days. This trend has intensified since early May, noting that the investor accumulation increased and the pressure side pressure reduces. External flows of exchange are often seen as a sign that holders intend to store ETH outside the exchange, reducing immediate supply and supporting upward price movement.

With the market’s feelings turning into a rise and leading Ethereum this charge, all eyes are now on whether ETH can maintain its momentum and push the Altcoin market to a new growth stage. If the accumulation and gossip trends keep main levels, the ETHEREUM path can open the door to the largest market gathering.

Related reading

Price procedure details: ETH Main level test

ETHEREUM weekly chart shows a strong interruption after weeks of declining pressure, as ETH is now trading about $ 2,599.14. The last increase paid the price above the EMA for 200 weeks (2,259.65 dollars) and SMA for 200 weeks (2,451.55 dollars), two long -term two indicators. Restore these levels, regenerate the ups and a strong conversion in feelings.

The short candle itself is one of the largest weekly green candles in more than a year, which reflects a sharp flow of the buyer’s interest and may be possible to achieve a main reflection point after months from the negative side. It is worth noting that this step brings ETH to levels that have not been seen since February, with the highest local level of the week to $ 2739.05.

The size increased significantly during this step, confirming the strength behind the assembly. However, ETHEREUM is now facing general resistance near $ 2800 – 2,900 dollars, an area that was previously operating as support during early 2024 before collapse. If the bulls keep the momentum and close this week over $ 2600, it can open the door to test the resistance area of $ 3,100.

Related reading

On the downside, the main support is to see about $ 2450, and is in line with SMA for 200 weeks. Failure to keep this level can be called for a re -test of $ 2,250. Currently, the trend is upward, but the follow -up next week will be very important.

Distinctive image from Dall-E, the tradingView graph