$ 1.14 billion has been eliminated while the market faces a double attack?

The encryption market today has witnessed a sharp fall. The main reason for this is the war tensions between Israel and Iran. The conflict escalated again as Israel launched an air strike on Iranian nuclear facilities on June 13. Moreover, the latest inflation report on the US Federal Reserve rejected any interest rates in June.

This double pressure from political geography and monetary policy has sent shock waves across the market, which led to more than $ 1.14 billion of references. When encryption dealers took the biggest burden, many sought a shelter in the safest origins such as gold, with PAX and gold between rare green symbols in a sea of red.

$ 1.14 billion.

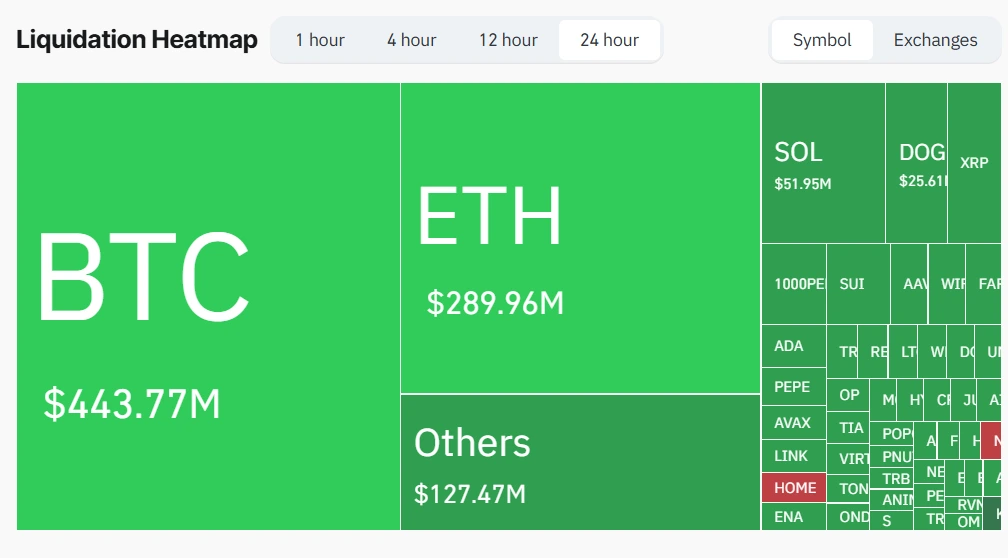

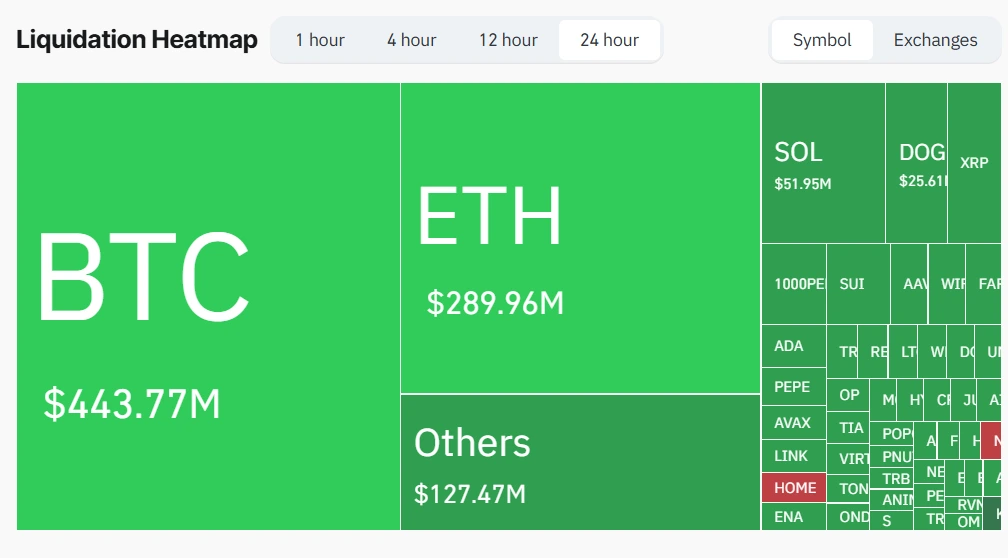

Within the past 24 hours, 246,590 merchants have been filtered, highlighting the severe pieces in the derivative market. The total references increased from the time of the press to $ 1.14 billion, focusing on the extreme volatility caused by external factors.

The largest filter was recorded on the Binance’s BTC/USDT pair, giving the jaw 201.31 million dollars. Binance formed the largest share in general, as it recorded 455.60 million dollars, followed by bybit after 370.83 million dollars, and OKX with 125.58 million dollars.

Bitcoin and Ethereum have taken the largest burden among cryptocurrencies, with 443.77 million dollars and 289.96 million dollars, respectively, in the volume of liquidation. Other altcoins, such as Sol, witnessed $ 51.95 million, and Dog took $ 25.61 million in the liquidation.

Where is the encryption market heading?

At the time of the press, the total market value of the industry is $ 3.37 trillion, a decrease of 2.51 %, while trading volume decreased 24 hours by 4.77 % to 129.97 billion dollars. Fear and greed indicator remains a degree driven by the greedy 61, which is expected to decrease with today.

Bitcoin is currently trading by 3.12 % less than 104,437.94 dollars, while ETHEREUM has achieved greater success, a decrease of 8.85 % to $ 2,517.03. The main takinate also faced pressure, as XRP made a loss of 5.47 % to $ 2.12 and reduced 9.74 % to $ 144.33.

With BTC dominance by 63.2 % and ETH by 9.8 %, the market still depends on bitcoin flexibility. However, unless geopolitical risks and overall economic stability returns are settled, the downside can be another in the store.

Also read the Pitcoin price (BTC) 2025, 2026-2030!

Do not miss any rhythm in the world of encryption!

Stay in the foreground with urgent news, expert analysis, actual time updates about the latest trends in Bitcoin, Altcoins, Defi, NFTS and more.

Common questions

The increasing war tensions between Israel and Iran, as well as inflation data from the Federal Reserve, caused the sale of panic and long liquidation via the stock exchanges.

Binance and Bybit have seen the largest stock on the stock exchange, while Bitcoin and Ethereum led the distinctive symbol boxes with $ 443.77 million and 289.96 million dollars, respectively.

Yes, gold -backed symbols such as Pax Gold and Tether Gold gained a traction as investors sought safety amid global uncertainty.